What income level determines how much you pay for Medicare? Many people don't realize Medicare uses your taxable income to calculate premiums. Here's how this income-related monthly adjustment amount (IRMAA) works and what income ranges will impact your Medicare premium costs.

Medicare Part B and Part D Base Premiums 2023

Before looking at income adjustments, it helps to understand the base Medicare premium amounts:

Part B Premium - The standard Part B premium for 2023 is $164.90/month. This applies to individuals with income of $97,000 or less.

Part D Premium - Varies by plan but averages around $32/month in 2023 for standard coverage. Higher earners pay more.

These are the baseline premium costs before any income-based adjustments. High earners will pay surcharges on top of these amounts.

What Triggers Higher Medicare Premiums

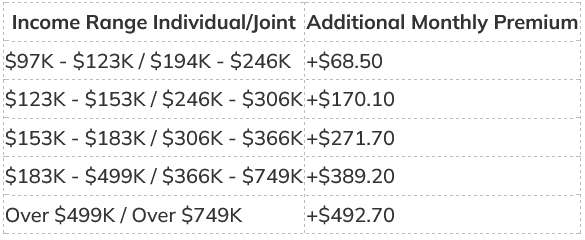

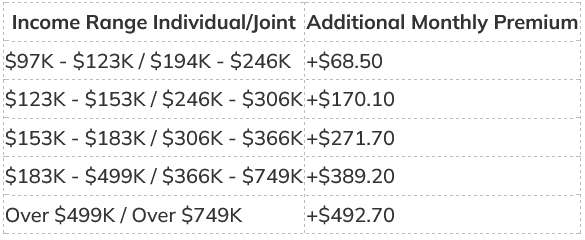

Medicare Part B and D premiums are higher if your income exceeds $97,000 as an individual tax filer or $194,000 for a married couple filing jointly. The extra premium amounts are called IRMAA (income-related monthly adjustment amount).

Income levels are based on your latest federal tax return from two years prior. So your 2023 premiums use your reported Modified Adjusted Gross Income (MAGI) on your 2021 IRS tax return.

MAGI includes adjusted gross income plus any tax-exempt interest income you received. Social Security benefits are not counted. The highest IRMAA bracket for 2023 is $750,000 individual / $1.5 million joint filers.

Impact on Part B and Part D Plan Premiums

Here are the income brackets and additional premium amounts added for 2023:

These affect both your Part B and Part D premiums. The income thresholds may be a bit higher than you expect. Married couples get some leeway owing to combined income.

How Medicare Calculates Your Income

Your MAGI and household size on your federal tax return are used to determine if you'll pay a higher Part B and D premium. Make sure your filed return accurately reflects your income.

If you filed married filing jointly, you get double the income allowance compared to an individual return before IRMAA surcharges kick in.

Notified Via Mail Each Year

You'll be notified by letter if you are subject to IRMAA based on your tax return. This notice is sent each fall in time for you to factor in the higher premium during Medicare open enrollment.

If your income has gone down more recently, you can file an appeal by submitting evidence to request reducing the premium.

Plan Smart Knowing Higher Income Means Higher Costs

Even at middle class retirement income levels, your Medicare costs increase compared to the base amounts. Make sure to factor this in as you budget healthcare expenses and weigh Medicare Plan options each year.

Understanding how Medicare premiums are calculated can help you project costs more accurately during retirement and reduce surprises at enrollment time.

We’re Here to Help

You do not have to spend hours reading articles on the internet to get answers to your Medicare questions. Give the licensed insurance agents at Golden Years Design Benefits a Call at 1-732-526-7659. You will get the answers you seek in a matter of minutes, with no pressure and no sales pitch. We are truly here to help.

FAQs

What is the income limit at which my Medicare premiums increase in 2024?

The income limit at which your Medicare premiums increase in 2024 is determined by your modified adjusted gross income (MAGI) from two years prior, which is your 2022 tax return.

How do higher income affect my Medicare premiums?

If your income is above a certain threshold, you may be required to pay higher premiums for Medicare Part B and Part D, known as Income-Related Monthly Adjustment Amount (IRMAA).

What does IRMAA stand for in relation to Medicare costs?

IRMAA stands for Income-Related Monthly Adjustment Amount, and it refers to the additional amount high-income beneficiaries are required to pay for Medicare Part B and Part D premiums.

Which tax year is used to determine the income-related premiums for Medicare in 2024?

The income-related premiums for Medicare in 2024 are based on the most recent tax return available, which is the tax year 2022.

How can I avoid paying higher premiums for Medicare?

To avoid paying higher premiums for Medicare, you can consider strategies to reduce your MAGI, such as contributing to retirement accounts or utilizing other tax planning methods.

What are the income limits for Medicare in 2024?

The income limits for Medicare in 2024 determine whether you will be subject to higher premiums for Part B and Part D based on your modified adjusted gross income from 2022.

What are the Medicare savings programs available for individuals with higher income?

Medicare offers various savings programs for individuals with higher income, such as the Medicare Savings Program, which helps cover costs like premiums, deductibles, and coinsurance.

How are the monthly Medicare premiums affected by higher income?

A If your income is higher, you may be required to pay higher premiums for Medicare Part B and Part D, impacting your monthly Medicare costs.

What is the premium for Medicare Part B in 2024 if my income has gone up?

If your income has increased, your premium for Medicare Part B in 2024 could be higher due to the income-related adjustments set by the Centers for Medicare & Medicaid Services.

What are the rules for higher-income beneficiaries regarding Medicare in 2024?

Higher-income beneficiaries are subject to specific rules and income-related premium adjustments for Medicare in 2024, affecting their Part B and Part D premiums.